Santander Pay In Cheque App Uk

Download the Santander Mobile Banking App. 4.7 out of 5 Rating. Based on 234K ratings on the App Store as of 1/26/2021. Pay your Santander credit card When you've downloaded it, open the app and follow the instructions to get started. If you don't already have Online Banking log on details, you'll need to sign up and have your account details to hand. You can also try the app with our online demo or email yourself a link to download it.

- Can I Pay In A Cheque Using Santander App

- Can I Pay In A Cheque Santander App Uk

- Santander Pay In Cheque App Uku

- Santander Pay In Cheque App Uk Online

We know getting to a branch in opening hours can sometimes be difficult. That’s why we’ve created an easier way to pay in your cheques using your smartphone and the Barclays app – saving you a trip to the bank.

How does it work?

Open the ‘Pay in a cheque’ feature within the Barclays app1. Enter the payee details and amount, then take a photo of your cheque.

The money will typically arrive in your account by 23:59 the next working day2 (if your cheque was paid in before 15:59 on a working day) so you don’t need to wait days to access your money.

A beginners guide to paying in cheques with your app

Watch a video to learn on how to use the Barclays app to pay in a cheque.

If the cheque is cashed in before 15:59 on a working day (Monday to Friday, except bank holidays), it’ll clear by 23:59 the next working day. It will appear in your account almost instantly, but the money won’t be available until the cheque has cleared and appears in your available balance.

Yes, we accept most cheques from UK banks, although some issuing banks don’t allow you to clear cheques using a photo yet. If you try and pay in a cheque from one of those banks, you’ll get a message telling you to take the cheque to a branch to pay it in.

You can use your app to pay in four cheques every seven days into a personal account.We may change these limits at any time. If you need to pay in more cheques than the above amounts, please go to your local branch.

The day you pay your first cheque in via the app. The count is reset every seven days following that day.

The cheque may still have gone through. Check by clicking on ‘View cheques paid in’. if you’re cheque is listed there, it’s gone through. If not, try paying it in again when you have better reception.You can’t pay in the same cheque twice, so you don’t need to worry about that. If you try to, we’ll notify you.

Your camera may not have captured all of the information we need. Take another photo and make sure that:- The background is plain and darker than the cheque

- The cheque is at least 15cm away from the edge of any desk or table

- The lighting isn’t too bright or dark

- All four corners of the cheque are clear

- Your camera is facing the cheque, not at an angle

- You hold your camera still when you take the picture

Some smartphone cases interfere with the camera, so removing the phone from the case can make photographing your cheque easier.

If you've tried this and the problem continues, please pay in your cheque at a branch.

Yes, there are. You can only pay in cheques for up to £500.You have to be registered for the app and use most updated version of it. You can only pay pound sterling cheques into a Barclays sterling account.

At the moment, we don’t support every sort code. If the sort code on your cheque isn’t supported, we’ll tell you when you try to pay it in.

There’s a weekly limit of four cheques per week that you can pay into a personal account using your app.

We’ll let you know what to do if you find you can’t process your cheque using your phone. You can also get in touch with us by clicking on the ‘Call us' icon in your app.

We recommend you to write 'paid in' on the back of your cheque and then keep it for at least ten days, just in case we need to contact you about it.

You must have a current account with us, be aged 16 or over and have a mobile number to use the Barclays app.Return to reference

‘Working day’ means Monday to Friday, except bank holidays.Return to reference

Banks may soon require you to use your mobile phone to validate online payments – but if you don’t have one, or live in a mobile coverage blackspot, you could be left out in the cold.

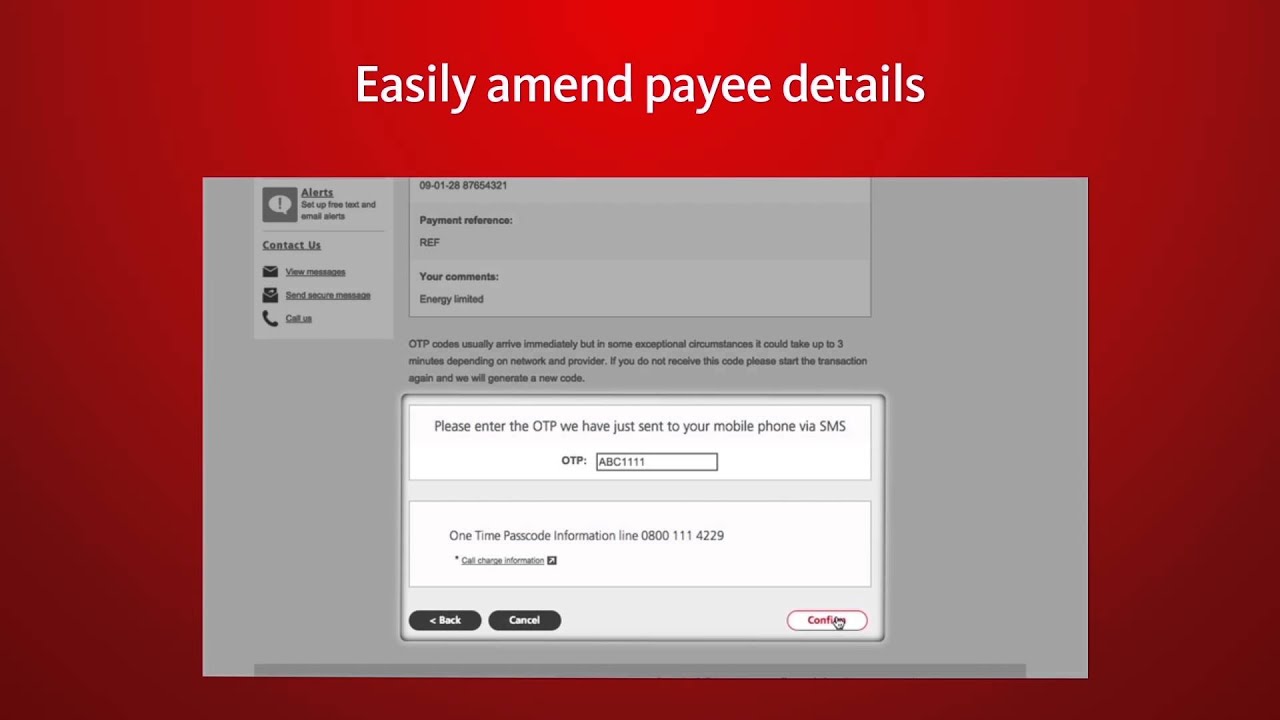

From 14 September 2019*, you’ll no longer be able to pay online using just your credit or debit card details, as payment service providers across the EU introduce an additional layer of security to better defend against fraud.

Banks are telling customers to confirm online card payments by entering a unique security code sent by text message or via push notification (if you have the mobile banking app).

While these extra steps should make online payments safer, an exclusive Which? Money investigation has revealed that customers who don’t – or can’t – use a mobile phone may be forced to call their bank or visit their local branch to complete online security checks.

Find out how your bank intends to implement this change.

*UPDATE* On 13 August 2019, the Financial Conduct Authority agreed to give the payments industry more time to implement SCA. There will now be an 18-month managed roll-out, although some banks are already making extra security checks.

Online card security: what is changing?

The requirement to validate payments using your mobile phone are part of plans for ‘strong customer authentication’ under the Payment Services Regulations 2017 (PSD2).

Under these rules, banks will be required to identify every customer using at least two independent factors of authentication, either:

- something only you know (a password or Pin);

- something only you possess (a card reader or registered mobile device); and

- something only you are (a digital fingerprint or voice pattern).

If this isn’t possible, payments will be declined, although low-risk payments are exempt. These will include recurring payments after the initial setup, and transactions below €30 or equivalent (until the cardholder makes more than five exempt payments in a row, or the total value hits €100).

How will banks make these checks?

Encrypted push notifications are the slickest and most secure form of two-factor authentication. These alerts, which are sent through mobile banking apps, confirm the transaction amount and payee, and are authorised by fingerprint ID or other biometrics.

Alternatively, banks can send a one-time passcode by text or email, which must be entered online for authentication. This is less secure than push notifications because messages can be hijacked.

If you don’t have a mobile, codes can potentially be sent to landlines, but only a handful of providers told us they’re considering this.

Find out more:Which? Computing – what is two-factor authentication and should you use it?

Which banks are insisting on mobile security checks?

When we asked banks how they’ll adjust security checks for customers without mobiles, it became clear there isn’t a consistent approach.

The most inflexible banks are Santander, M&S Bank, HSBC and First Direct. Customers who don’t use a mobile will have to call their banks using a landline to go through the final stages of the online purchase process. Santander said customers can also access accounts and make payments in their branch.

Other banks said customers can get security codes by landline as well as mobile, including Lloyds Banking Group (Lloyds Bank, Bank of Scotland and Halifax), Tesco Bank and TSB.

Can I Pay In A Cheque Using Santander App

Lloyds added that if a mobile/landline number isn’t held, new payees must be added in-branch and some online credit card payments won’t go ahead.

Royal Bank of Scotland Group (RBS, NatWest and Ulster Bank), Co-operative Bank and Nationwide said OTPs can be sent to an email address where a mobile phone isn’t available, though none has plans to use landlines. Codes can be sent via email for M&S Bank, HSBC UK and First Direct customers, but only on a limited or temporary basis.

Nationwide added that it is looking to expand the use of its card readers, which are already used for online banking login.

Meanwhile, customers of Barclays,Clydesdale and Yorkshire Banks (CYBG), Virgin Money and Metro Bank will have to wait and see, as these banks told Which? that the final process is yet to be determined.

One in five Which? members excluded

The aim of the additional security is to reduce card-not-present fraud, by forcing banks to use multiple factors of authentication to confirm that it’s really you making a purchase.

Can I Pay In A Cheque Santander App Uk

However, when we surveyed 1,838 Which? members in March 2019, nearly one in five told us they could be excluded from making online card payments entirely, either because they don’t own a mobile phone (4%) or have poor mobile phone signal at home (13%).

Reports of patchy reception came in from Which? members all over the UK – including Basingstoke, Cheshire, County Durham, Dorset, Gloucestershire, Newark, Norfolk, Oxfordshire, Sheffield and Suffolk. Some members said messages can take up to two days to come through.

You can check reception in our local area using Which?’s mobile phone coverage checker.

Steve Burgess, 61, Surrey (pictured) feels lets down that his bank of many years, Santander, isn’t offering a viable alternative to mobile security checks:

‘I have been advised that the passcode system will not include the ability to send spoken messages to landline phones, so I’d have to have a mobile. This makes no sense. For one thing, it presumes satisfactory mobile reception at my home; for another, they are surely disenfranchising a swathe of loyal customers, many of whom will be classed as vulnerable.

‘My lifestyle does not require a mobile phone so I have never owned one; and I do all my online banking in arguably the most secure environment – my home, on a laptop which never leaves it.’

Santander Pay In Cheque App Uku

Members without phones or a reliable signal said they may be forced to ditch online banking and use local branches to make payments, but previous Which? research shows the UK has lost almost two thirds of its bank branch network in the past 30 years, leaving a fifth of households more than three kilometres from their nearest current account provider.

Santander Pay In Cheque App Uk Online

We’ve also been hearing from people who have been forced to close their accounts because they couldn’t supply a mobile phone number, or feel penalised because they aren’t willing – or able – to embrace the digital revolution: