Capital One Direct Deposit

Editor’s Note: As of January 28th, 2021, this offer is no longer available. We will update this post whenever this offer returns – until then, our post on the best bank bonuses and promotions has other offers that might interest you or click here to sign up for our email newsletter and get notified of new bank promotions.

Capital One is one of the most recognizable names in the financial world and Capital One 360 is their online banking arm. If you’re thinking about opening an account and want to know if they have any bonus offers – you’re in the right place.

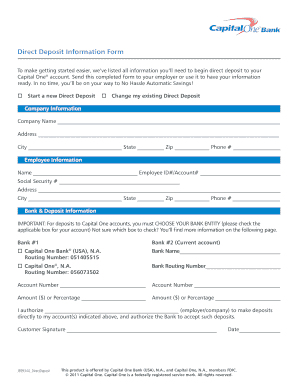

Loved ING Direct. Was a customer for many years, Savings and investments too! I now have to cancel my account because it is just too difficult to do anything since they became Capital One. Capital One is the worst bank ever. Tried to close out my IRA - for 2 years - still no luck getting it switched to another bank. Direct Deposit Information Form This product is offered by Capital One Bank (USA), N.A., and Capital One, N.A., members FDIC. © 2011 Capital One. Capital One is a federally registered service mark.

They offer up to $400 cash bonus for opening a 360 Checking account. There are several offers – the top one requires a direct deposit but there are two more, for less money, that only require you to spend a certain amount using the debit card.

Bank of America $100 New Checking Account Bonus

Bank of America will give you a $100 cash bonus if you open a new account by June 30th, 2021 and receive at least 2 qualifying direct deposits of $250 or more within the first 90 days. The monthly fee is easy to get waived.

Let’s see how you can get this Capital One 360 bonus:

Just open a Capital One 360 checking account by 1/26/2021 and then receive 2 direct deposits totaling $1,000 or more within 60 days of account opening. If you can’t meet the direct deposit requirement, there are two other offers that are based on spending (but they’re for less money).

The page will populate the promo code automatically but the promo code is BONUS400 on this offer.

That’s it!

There is, unfortunately, no bonus for the 360 Performance Savings account, just the checking.

Learn more about the offer

(Offer expires 1/26/2021)

How to Get up to $250 for a Capital One 360 Checking Account

If you don’t have a direct deposit that meets the requirements for the $400 offer, they also have two offers with a spending requirement.

If you think you can spend over $500 on your debit card in the first 90 days, you’ll want to open a 360 Checking account with the promotion code UPTO250.

Spend over $500 on your debit card within the first 90 days and you’ll get $150 into your account.

Spend over $1,500 on your debit card within the first 90 days and you’ll get $250 into your account.

Capital One Direct Deposit Issues

Bonus is deposited 60 days after the 90-day spend period ends.

Learn more about the offer

(Offer expires 1/26/2021)

If you cannot spend more than $500, then the next tier is at $300 in spending. Open a 360 Checking account by January 26, 2021 with the promotion code BANK100.

Then, use your debit card and spend at least $300 within 90 days of opening that account. You’ll get $100 in the account 60 days after your 90-day spend period ends.

These offers are less generous than the one listed above BUT it has no direct deposit requirement.

Learn more about the offer

(Offer expires 1/26/2021)

About Capital One 360

It only felt like yesterday that the term “online bank” felt like a novelty. ING Direct was still doing silly ads where people didn’t know how to pronounce “ING” (I still say the individual letters). They were acquired by Capital One in 2011 and turned into Capital One 360 – the bank we’re talking about today.

Capital One 360 is FDIC insured as Capital One Bank USA (FDIC #33954) and if you want a deeper dive into the bank’s offering – our Capital One 360 review does a good job outlining it all.

Just as an aside – even without the bonus, Capital One 360 is a pretty good online bank. They have great rates, practically no fees, and one of the nice features is that you can open separate savings accounts for different savings goals. You can do it all online pretty quickly and each one will have its own account number, so you can set up automatic transfers to help with savings. It’s a good way to do envelope budgeting without actual envelopes.

So it’s a case where you come for the bonus but stay for the bank’s other features.

What To Watch For

You are not eligible for this bonus if you’ve had or had an open 360 checking account (as primary or secondary) on or after January 1, 2018.

Capital One Direct Deposit Issues

Otherwise, no other things to watch out for – the account has no monthly fees, no minimum balance, and no gotchas to speak of. I’ve had an account at Capital One 360 for over ten years (it started as an ING Direct account) and have yet to pay a fee.

Plus it earns an interest rate of 0.40% APY, as of .

Capital One Quicksilver Cash Rewards Credit Card – $200

The Capital One Quicksilver Cash Rewards is a credit card that will give you $200 after you spend $500 on purchases within 3 months of opening an account.

You also get 1.5% cashback on every purchase, it’s a solid cash back card with no annual fee.

How Does This Bonus Compare?

It’s a pretty solid offer because a bonus of $400 for just is great.

For example, Chase Bank has a competitive bonus too where you can get up to $350 for opening a new checking AND savings account. For their offer, you will have to set up a direct deposit to a Chase Total Checking account AND transfer in $10,000+ in new money to the Total Savings account. This nets you a $200 bonus for the checking and $150 for the savings.

Also, if you want to get $400 from Wells Fargo (this offer is currently not available, we just include it as a reference), you’ll have to open an Everyday Checking account and receive a total of $4,000 or more in qualifying direct deposits into the new checking account within 90 days from account opening within 90 days. It requires just a $25 minimum deposit so the dollar amount is quite low but you’ll have to adjust your financial system so this account gets a direct deposit, likely from your full-time job.

As you can see, this Capital One 360 bonus account is easier because it requires a relatively small direct deposit. Not all offers are this simple, review our guide on bank account bonuses to see what other banks typically require as a comparison.

What is the routing number for Capital One? Find the right one for your account with our guide.

- Capital One Routing Numbers by State

- Other Ways to Find Your Capital One Routing Number

- Routing Numbers for Domestic and International Wire Transfers

Routing numbers are 9-digit numbers that banks use to identify themselves. Think of them as addresses that let other banks know where to find your money.

You need your routing number for many tasks, including:

- ACH payments

- Setting up direct deposit

- Receiving benefits from the government, including tax refunds

- Transferring money between accounts at different banks or investment firms

- Automatic bill payment

- Domestic wire transfers

Capital One has two routing numbers associated with their two business entities, Capital One Bank (USA), N.A. and Capital One, N.A.

Keep reading to find the right Capital One routing number for your transactions.

Capital One Routing Numbers by State

Your routing number is associated with the institution or entity where you opened your account. You can find that entity on your bank statement located to the right of your account number.

Here are the routing numbers by bank institution:

| Bank Institution | Routing Number |

|---|---|

| Capital One Bank (USA), N.A. | 051405515 |

| Capital One, N.A. | 056073502 |

Capital One Direct Banking

If you are unsure what institution holds your money, keep reading for other ways to find your Capital One routing number.

Is There a Routing Number on Your Debit or Credit Card?Although your debit card is associated with a bank account, you do not use a routing number for debit card transactions. Routing numbers are only used for transfers directly between bank accounts.

Likewise, credit cards do not have routing numbers since they are not directly linked to any bank account.

Other Ways to Find Your Capital One Routing Number

Use a Check

Find the routing number in the lower left-hand corner of the check corresponding to your checking account. It's the first 9 digits located at the bottom of each check.

Go Online

Access your online bank statement by logging in to your account. To the right of your account number will be your Capital One bank entity. Once you know your bank entity, you can determine your routing number using the list provided above.

Call Customer Service

If you don't have online checking or a check handy, call Capital One at 888-810-4013. After you provide a few details to identify yourself, a representative will be able to confirm your account's routing number.

The first four digits pertain to the Federal Reserve. The next four digits are unique to your bank. Consider those the bank's address for the Federal Reserve. The final digit is a mathematical calculation of the first eight digits—it's used to prevent check fraud.

Routing Numbers for Domestic/International Wire Transfers

Wire transfers are a faster way to send money than an ACH transfer, though they typically cost a small fee. In order to send a wire, you'll need to fill out Capital One's Outbound Wire Request Form and mail/fax it for processing.

To Make a Domestic Wire Transfer

Use the routing number that corresponds with your account's bank entity. The Capital One Bank (USA), N.A. routing number for wire transfers is the same as the routing number used for direct deposits and ACH transfers.

| Bank Institution | Routing Number |

|---|---|

| Capital One Bank (USA), N.A. | 051405515 |

| Capital One, N.A. | 056073612 |

Incoming (Domestic and International): $15.00

Outgoing (Domestic): $25.00

Outgoing (International) in foreign currency: $40.00

Outgoing (International) in USD: $50.00

You'll also need the following information for domestic wires:

- The name of the person to whom you're wiring funds (the 'beneficiary') as it appears on their account

- The name and address of the beneficiary's bank

- The routing number of the beneficiary's bank

- The beneficiary's account number

To Make an International Transfer

Use the Capital One SWIFT code HIBKUS44.

SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes are the international equivalents of the US routing numbers. They direct the money to the correct bank for international transfers.

You'll also need the following information for international wires:

- The name of the person to whom you're wiring funds (the 'beneficiary') as it appears on their account

- The name and address of the beneficiary's bank

- The beneficiary's bank account number; for many international transfers, this is called the IBAN number

- The SWIFT code of your bank and the bank you are sending to

- Currency being sent

- Purpose of transaction

Before submitting a wire transfer for processing, it's a good idea to double-check you have all the necessary information entered correctly.

Which Capital One Routing Number Should You Use?

Domestic Money Transfer Activity

Use the ABA routing number associated with your account's Capital One entity:

| Bank Institution | Routing Number |

|---|---|

| Capital One Bank (USA), N.A. | 051405515 |

| Capital One, N.A. | 056073502 |

Domestic Wire Transfers

Use the Capital One wire transfer routing number associated with your account's Capital One entity:

| Bank Institution | Routing Number |

|---|---|

| Capital One Bank (USA), N.A. | 051405515 |

| Capital One, N.A. | 056073612 |

International Wire Transfers

Use Capital One SWIFT code HIBKUS44.

Bottom Line

You'll likely need your Capital One routing number when managing your finances. Keep it handy should you need to set up a direct deposit, automatic payment, or wire transfer.

Write to Andrea Sielicki at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Note: This website is made possible through financial relationships with some of the products and services mentioned on this site. We may receive compensation if you shop through links in our content. You do not have to use our links, but you help support CreditDonkey if you do.

Read Next:

|

|

|